Section 2(11) Income Tax: Block of Assets - Meaning & Concept

Section 2(11) of Income Tax defines 'Block of Assets' as a 'group of assets' in respect of which the same percentage of depreciation is to be applied

:max_bytes(150000):strip_icc()/TermDefinitions_Fixed_Asset_Turnover_Ratio_-d269a3bf50b040dcb50552ac0ac79e4f.jpg)

Fixed Asset Turnover Ratio Explained With Examples

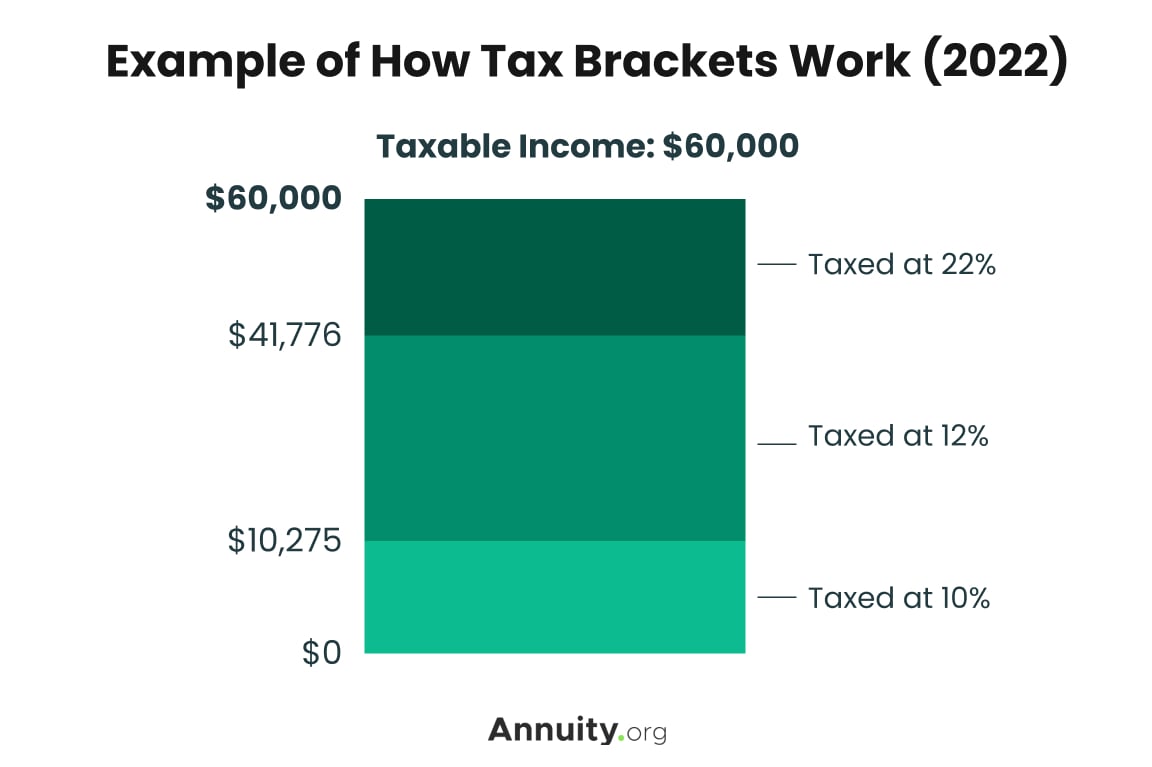

Tax Brackets for 2023-2024 & Federal Income Tax Rates

Financial Goals - Meaning, Examples, Types

Free Tax Calculators & Money Saving Tools 2023-2024

8 ways to calculate depreciation in Excel - Journal of Accountancy

TAX PLANNING REGARDING DEPRECIATION” - ppt download

Section 50 of the Income Tax Act: What You Need to Know - Fisdom

How to Calculate Capital Gains Tax

Understanding the Balance Sheet Statement (Part 2) – Varsity by Zerodha

Why do we have a concept like block of assets for charging depreciation in the income tax act of 1961? What were the lawmakers thinking? - Quora

How to Reduce Your Taxes as a Working Musician

What Does a Financial Advisor Do? Definition and Examples

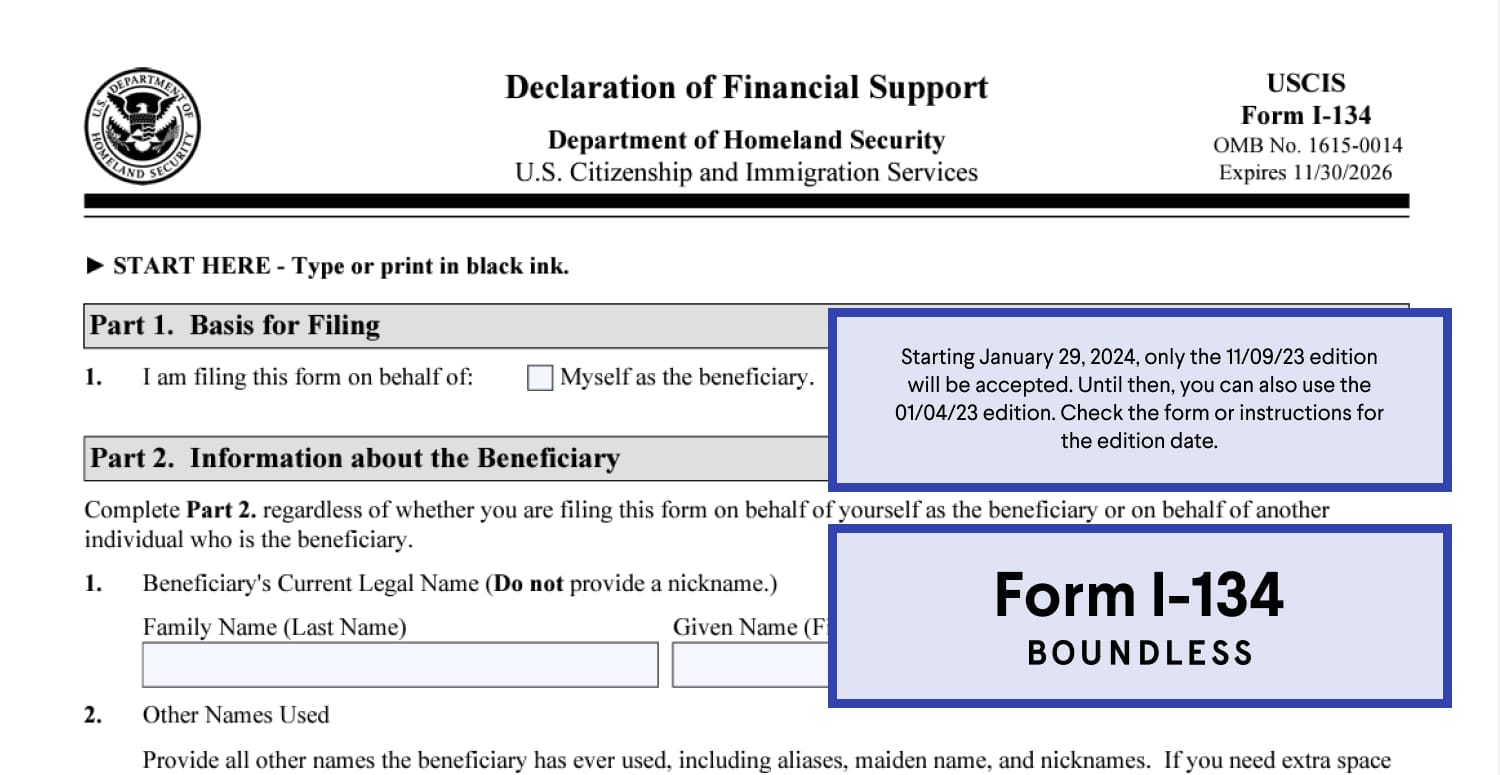

Form I-134, Explained - Declaration of Financial Support

Expecting a Step-Up on Your S Corporation Acquisition? Structure Carefully!, Alvarez & Marsal, Management Consulting

Instructions for Form IT-203