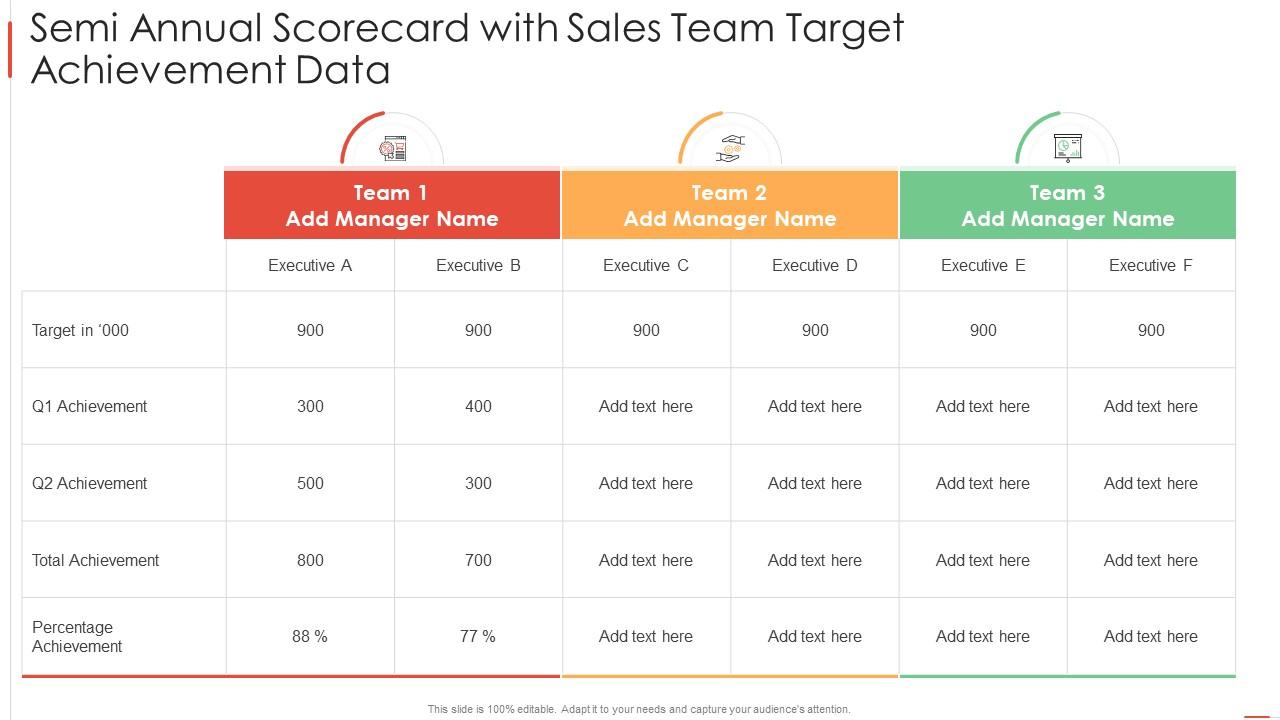

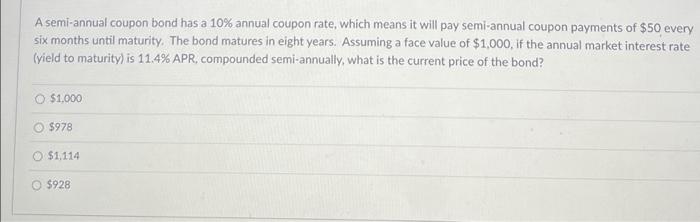

Solved A semi-annual coupon bond has a 10% annual coupon

SOLUTION: Week3 - Studypool

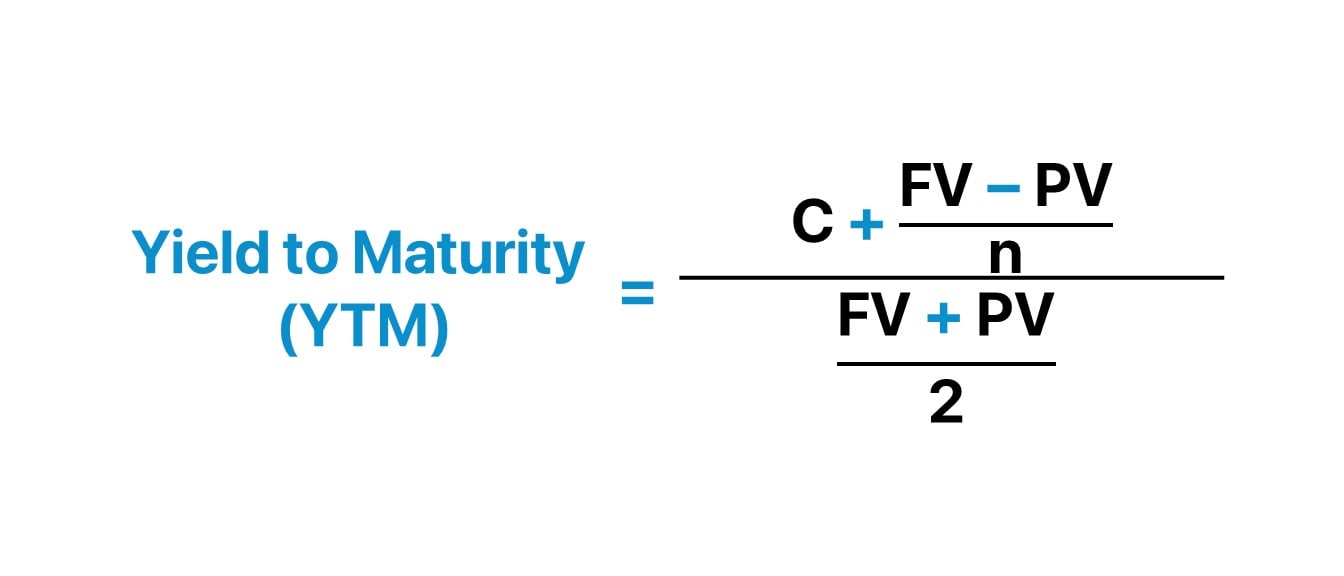

Tutorial 6 - Solution - Compound Interest Bond prices and yields Corporate Bonds No Arbitrage in - Studocu

Yield to Maturity (YTM)

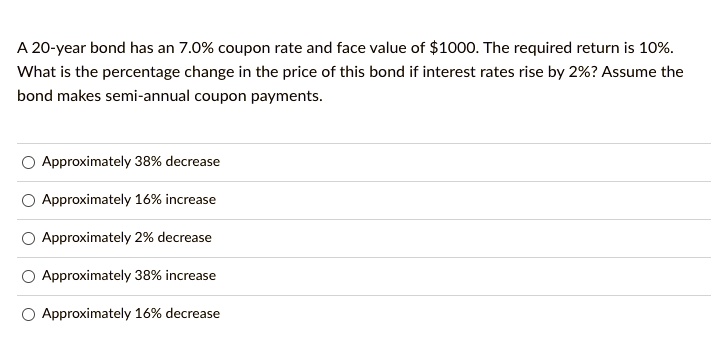

SOLVED: A 20-year bond has a 7.0% coupon rate and a face value of $1000. The required return is 10%. What is the percentage change in the price of this bond if

Bond Valuation - Wize University Introduction to Finance Textbook

Which of the following $1000 face value bonds has a 10% yield, assuming semiannual coupon payment of 8% A. A 5-year maturity bond selling for 964.54 B. A 10-year maturity bond selling

Week10 Homework Assignment Solution BKM page 480

Chap 9 bonds

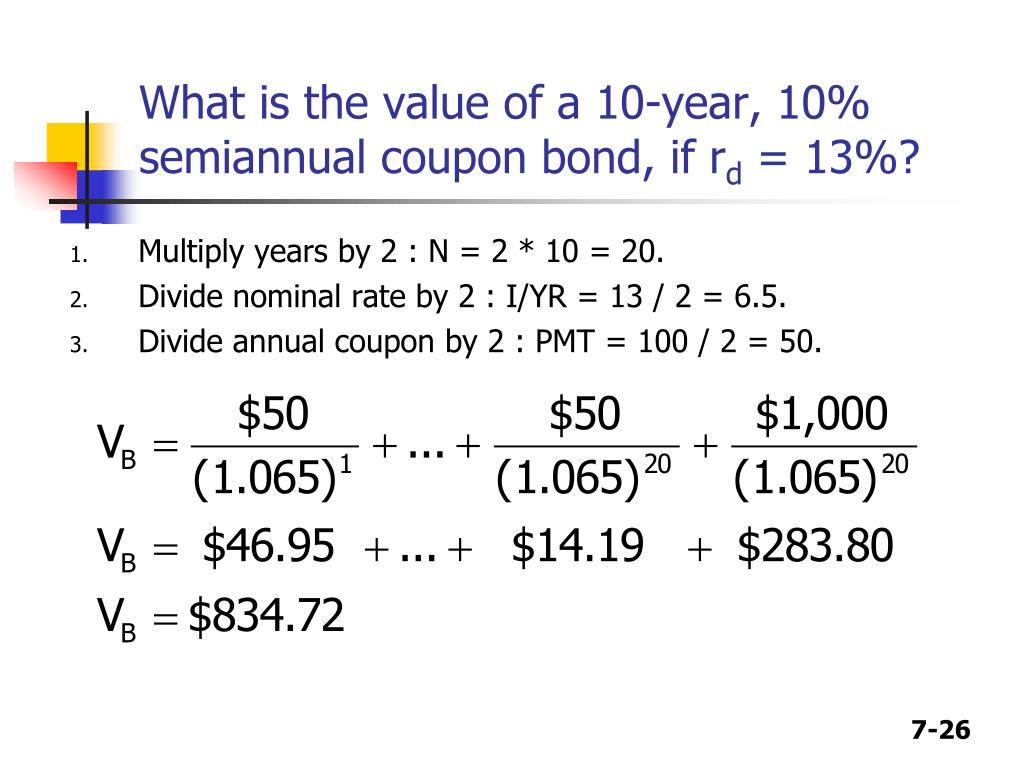

PPT - CHAPTER 7 Bonds and Their Valuation PowerPoint Presentation, free download - ID:6551211

Introduction To Fixed-Income Valuation - 1: Question #1 of 70, PDF, Bonds (Finance)

Coupon Bond Formula Examples with Excel Template

Modified Duration - Zero Coupon Bond Modified Duration Formula